"Everything was going well, then the shock!" This is how Steve Guillou (CEO of arkose&co) summed up the current situation of indoor sports in France, during a Webinar on this topic, organized on March 25, 2021 by the ESSEC Alumni Sports Club, with the presence of Guillaume Debelmas (Co-Founder and Co-CEO of Le Five Group) and Marie-Anne Teissier (Co-Founder of Neoness and Episod).

On the threshold of the reopening of indoor sports facilities, at least for non-contact sports, announced by the French government for June 9th, these three experts discuss the promising growth prospects of the sector, completely turned upside down by the COVID-19 crisis.

Financial issues are facing indoor sports stakeholders: even if short-term financing needs have been partially resolved by the public support, the matter of bank debt is still pending. More generally, the question is to wonder whether the industry was cut off at the height of its boom. Will the conditions for reopening be sufficient to generate profit? Will the stakeholders succeed in winning back their customer bases? Will the current reinvention of the sports offer, particularly in light of digital technology, impact the industry?

Sport indoor as been hitten hard by the pandemic

The COVID-19 crisis, leading to the closure of all sports facilities, has done some damage to the indoor sports industry. It is true that the government has supported these companies with the PGE (Prêt Garanti par l’Etat), but this has only provided relief in the short term; on the long run, these companies will have to pay off a huge debt and thus will need to revise their development forecasts downwards. Despite a re-opening of indoor sports facilities during the summer, all these spaces are now closed again, without much certainty about the future. The French Government announced the reopening of indoor sports facilities as of June 9th, officially only for non-contact practices. What about indoor soccer? Will it have to wait until July? For the rest, under which conditions (mandatory mask, social distancing, density)? Will public support be maintained if health conditions do not allow profitability to be achieved?

State of play: an increasing demand with an established growth

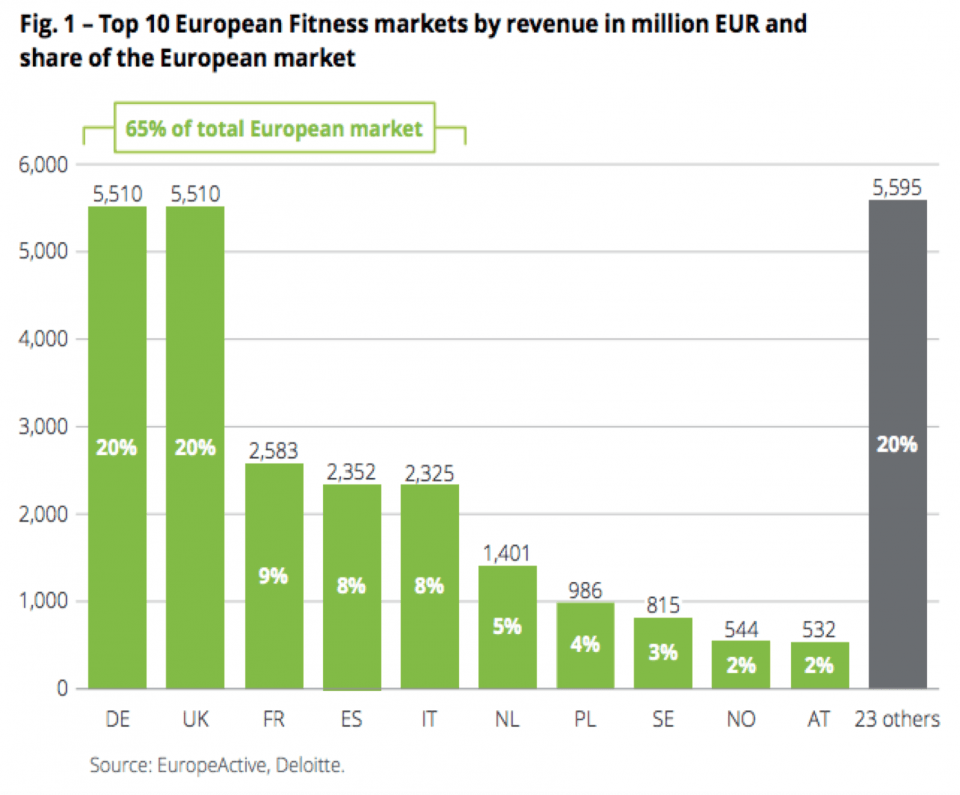

According to the 7th edition of the report "European Health & Fitness Market" [1] jointly conducted by Deloitte and EuropeActive and published in April 2020, the European fitness market represents a global turnover of €27.2 billion, including €2.5 billion for France, with nearly 6 million members spread over more than 4.300 clubs. Le Five, Neoness and arkose&co are mainly based in urban areas, in medium to large cities.

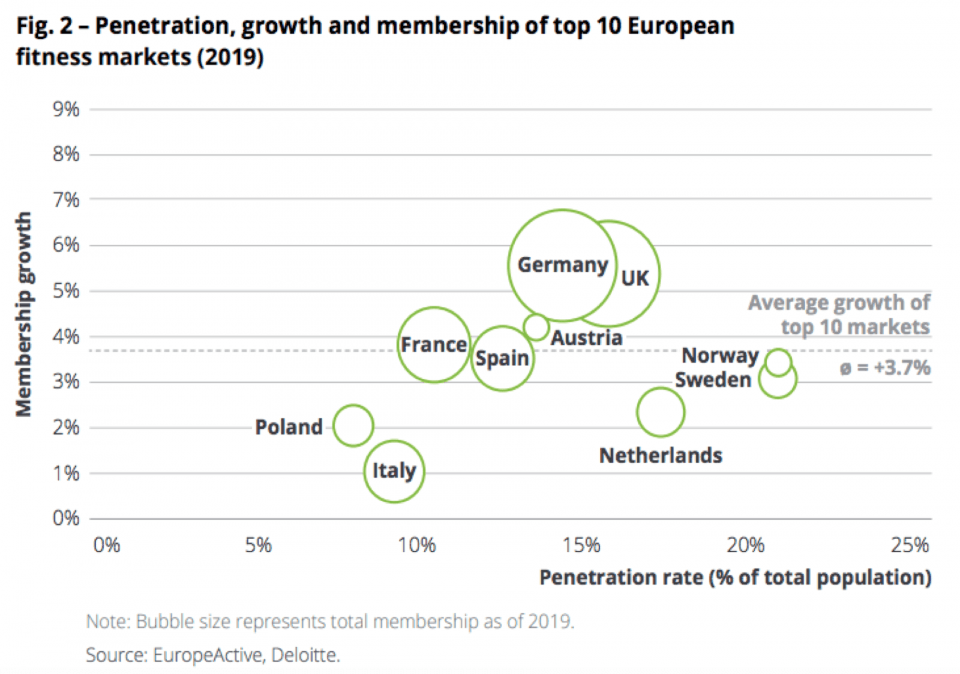

The same report states that 8.1% of the European population subscribed to a fitness club membership card in 2019. The penetration rate for people aged +15 years is 9.7%. High penetration rates in Northern and Central European countries were partially offset by lower ones in the Southern and Eastern European fitness market. Germany and the United Kingdom remain the two largest fitness markets in Europe, each with an annual revenue of €5.5 billion. These two leaders are followed by France (€2.6 billion), Spain (€2.4 billion) and Italy (€2.3 billion). Together, they represent 65% of the total European fitness market.

A change in sports consumption is driving this growth

One of the explanations for these increasing penetration rates is that fitness clubs in particular and indoor clubs in general are perceived as being places for sport and well-being, but also for socializing. They represent a space where one can create or consolidate social connections, as Steve Guillou attests. He says that 40% of arkose&co's climbing club’s turnover comes from its food & beverage sales; meeting up after sessions is an important part of customers’ experience. Another important element is the modularity of the practice: for football for example, "with a marked out and smaller field, the technical and physical barriers are much lower [in comparison with a classic 11 vs 11 match], in addition to flexibility and a sports practice that generally does not involve competition ", indicates Guillaume Debelmas; Result: "a more accessible football practice and a base of more than 5 million practitioners".

Sport practice seems to be moving from a collective model of federal licenses on the background of official and institutionally organized competitions to an individual model offering more conviviality and freedom. Private companies such as Le Five, Neoness and arkose&co can be seen as democratizing sports practice in France; rather than facilitating competition, their focus is on fun and physical and mental wellbeing. This trend is all the more encouraged by the contribution of digital technology, which will be the keystone of the customer experience in tomorrow's sports practice.

Future challenges: digital at the heart of tomorrow’s client-experience

The great growth experienced by the indoor sports sector was halted by the COVID-19 crisis, which nevertheless accelerated their digitalization process. "The day after the first lockdown, we set up a digital offer for our customers", specifies Marie-Anne Teissier. Many customers have therefore taken up home sports, increasing sales of the equipment needed for this purpose: at Go Sport, for example, over the year 2020, sales of dumbbells have jumped by 160%, while those of gym mats have increased by 112% and fitness machines by 90%. [2]

Digital technology is today the main lever for the development of the indoor sports sector, in that it allows for a better knowledge of customers and therefore more adapted value offers. However, digital technology could also be a competitor to the physical clubs in the future. For example, Zwift (an online sports platform that organized the first virtual Tour de France with home exercise bikes) raised the equivalent of €370 million [3] from the investment funds Permira and KKR [4], which are counting on the further development of this application that already has more than 2.5 million users.

What about tomorrow? Will customers return to clubs? "The vast majority of our clients (more than 95%) are willing to return to the club", answers Marie-Anne Teissier, who has not noticed a huge competition between in-club and at-home practices over the last months. Now, only a few more weeks to wait, for the clients as well as for the three entrepreneurs in this debate, before the reopening. We are looking forward to seeing you soon in their indoor sports facilities!

References:

[1] Deloitte & Europe Active. (2020).

An Overview of European Health & Fitness Market Report 2020.

[2] Garnier, J. (03/04/2021). Le Monde

Le « sport à la maison » enraye un marché du fitness déjà frappé par le Covid-19.

[3] David, B. (09/16/2020). Les échos

Zwift, le milliardaire du vélo virtuel, lève 450 millions de dollars.

[4] Michael, L. (09/16/2020). sportspromedia.com

Zwift raises US$450m in Series C funding round led by KKR.

Commentaires0

Vous n'avez pas les droits pour lire ou ajouter un commentaire.

Articles suggérés