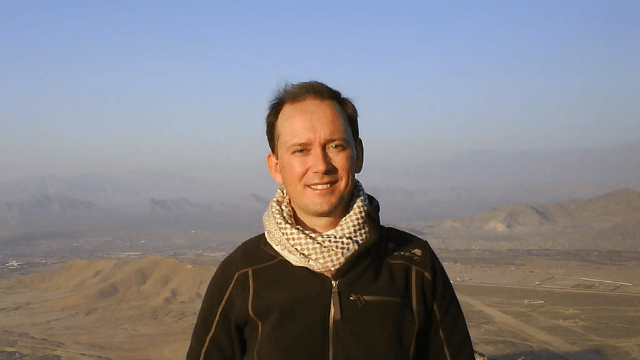

Sébastien Thiam (E99): “Afghanistan’s reconstruction was abandoned in 2014”

An expert in high-risk markets, Sébastien Thiam (E99) advised the U.S. military in their attempt to rebuild Afghanistan. He shares his views on the past 20 years and the Taliban’s comeback.

ESSEC Alumni: What are your activities?

Sébastien Thiam: A former French Navy Officer, I built an expertise in high-risk environments across international crisis management, strategic intelligence, and business diplomacy, through military deployments and advisory activities. I founded Makassar Partners, which helps its clients reduce risks in their plans for international growth, at the convergence of TPRM and ESG compliance.

EA: Can you describe your endeavour in Afghanistan?

S. Thiam: In the wake of the September 11 attacks, I put my entrepreneurial activities on hold and joined the operational reserve to be deployed within our Special Forces. Then, from 2009 to 2011 at the peak of the nation building effort, I served as a political adviser to the coalition commander (ISAF), respectively General Stanley McChrystal and General David Petraeus (for more info in our previous interview on ESSEC Alumni’s website, click here). I am the only Frenchman to have advised an American general.

EA: What was your mission?

S. Thiam: America’s ambitious and complex new strategy aimed to get out of the deadlock: "winning hearts and minds" of the Afghan people by accelerating progress, notably through building capable Afghan National Security Forces (ANSF), while revitalizing the economy. In 2010, the USGS1 estimated the mineral resource potential to be over $ 1000 billion. Thus, I relied on ISAF’s extraordinary resources and talents and leveraged a previous effort in Kosovo to advise and assist the Minister of Mines also heading the government’s cluster for economic development, to attract foreign investors in natural resources and agribusiness through local and international roadshows and local assistance to investors.

EA: What did you achieve?

S. Thiam: A Swiss-based global agribusiness leader whose CEO I approached converted in 2017 a trade flow from Pakistan worth tens of millions of dollars annually into a local manufacturing operation, in line with initial plans. Also, thanks to our critical support, the Ministry of Mines awarded in 2011 a mining tender in iron ore to a consortium led by SAIL (India), which planned to invest 11 billion dollars over ten years, including the construction of infrastructure and the creation of nearly 10,000 direct and 40,000 indirect jobs.

EA: Could you then perceive risks of failure of the reconstruction effort?

S. Thiam: There were several enduring barriers: a pervasive underground economy, rampant and institutionalized corruption which facilitated the insurgents' decisive breakthrough, and last, the building-up of the ANSF which did not rise to the challenge. Thus, fragile gains earned through blood and treasure collapsed with the troop withdrawal. To illustrate my comment, I’d like to highlight that SAIL terminated its Afghan mining project as soon as 2015, shortly after ISAF pulled out of Afghanistan. The consortium blamed the resilience of the Taliban and poor economic viability due to lack of infrastructure and fall in commodity prices. The 3 billion dollars Mes Aynak copper contract, awarded to Chinese MCC late 2007, has yet to materialize amid disagreements with the former government over royalties and security.

EA: Looking back, was it possible to adopt a different approach?

S. Thiam: Former National Security Adviser to the US President, Lt. General H.R. McMaster, who served at ISAF from 2010 to 2012, recently considered that "ineffective strategies based on wrong assumptions” made this 20-year war "a one-year war fought 20 times over". Achieving a sustainable outcome in expeditionary private-sector development alone requires an enduring effort, which unfortunately was abandoned in 2014. Hence, I’m convinced that an independent investment fund, which can work in partnership with military forces, can make a difference in coordinating and bolstering economic reconstruction efforts in Afghanistan, like in other war-torn or post-conflict areas.

EA: What is your assessment of the current situation?

S. Thiam: The Taliban's communication strategy aims to bring about swift international recognition and a resumption of the massive financial aid Afghanistan relies on so heavily. Let’s not dismiss that their interim government includes individuals that were jailed in Guantanamo Bay detention camp, are under sanctions, are on the FBI's most-wanted list, or are linked by marriage to al-Qaida. Recent attacks by ISIS-K are also a stark reminder that security under this regime is not guaranteed. I believe a most pressing issue is: can Afghanistan morph once again into a haven for terrorism, and when?

EA: What are the economic prospects for the country – and for its people?

S. Thiam: The return of the Taliban changes the rules of the game. Whether they can build key economic infrastructure and manage a state is arguably an open question. Averting a major humanitarian crisis through international aid is an obvious priority for months to come. However, a revitalization of the Afghan economy goes hand in hand with the exploitation of at least some of its mineral potential.

EA: Can we imagine that certain forms of international cooperation and foreign investments will be upheld in Afghanistan under the Taliban regime?

S. Thiam: US Treasury sanctions should be an impediment to foreign investments for a while. Nonetheless, China and India initiated talks with the Taliban interim government to revamp their mining projects, against the backdrop of domestic security issues. Russia and Iran consider Afghanistan as an area of influence and could jumpstart cooperation. It is worth mentioning that Afghanistan’s mineral potential was already explored during the Soviet era.

Interview by Louis Armengaud Wurmser (E10), Content Manager at ESSEC Alumni

Want more content? Join us now so that we can keep bringing you news about the ESSEC network.

1 United States Geological Survey

Comments0

Please log in to see or add a comment

Suggested Articles